Do you have enough onshore exposure in 2022? – 27 January 2022

It is always difficult to articulate expectations of investment markets, particularly as the world is dealing with the impact of a multi-generational game-changing phenomenon, i.e. the Covid pandemic.

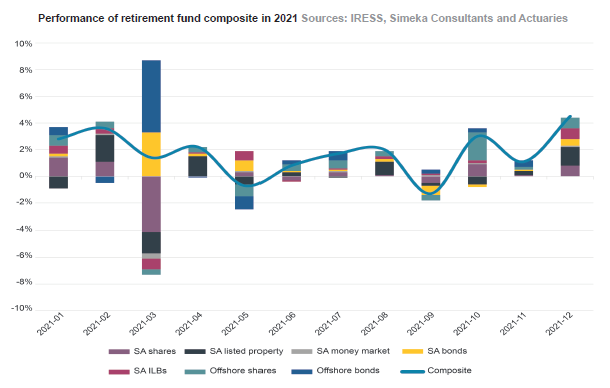

The following average returns were earned by asset managers and on asset classes over the past five years:

| Investment returns | 2017 | 2018 | 2019 | 2020 | 2021 | 2017-2021

% p.a. |

|

| Broad return earned by asset managers* | 14% | -4% | 12% | 6% | 23.5% | 9.5% | |

| Retirement fund benchmark** | 14.2% | -4.8% | 11.9% | 1.8% | 23.1% | 8.8% | |

| Domestic | Shares | 21.2% | -11.7% | 9.3% | 2.6% | 21.1% | 9.1% |

| Property | 17.2% | -25.3% | 1.9% | -34.5% | 36.9% | -4.0% | |

| Money market | 7.5% | 7.3% | 7.3% | 5.4% | 3.8% | 7.1% | |

| Bonds | 10.2% | 7.7% | 10.3% | 8.7% | 8.4% | 10.8% | |

| Offshore (in rand) | Shares | 12.7% | 5.6% | 24.2% | 22.6% | 29.2% | 18.6% |

| Bonds | -2.9% | 14.6% | 4.1% | 14.7% | 3.1% | 6.5% | |

| Rand (+rand strengthens, – rand weakens) | 10.6% | -13.8% | 2.5% | -4.7% | -7.8% | -2.8% | |

| Inflation | 4.7% | 4.5% | 4.0% | 3.1% | 5.5% | 4.7% | |

* Obtained from several surveys

** Retirement fund benchmark = 45% SWIX TR + 10% SAPY + 5% STeFI Composite + 10% ALBI + 30% MSCI World All Country Index [ZAR]

Sources: IRESS, Simeka Consultants and Actuaries

Interestingly, investment results in 2018 were much worse than the investment results in 2020, when markets pulled back because of the Covid pandemic.

So, what happened in 2018?

In 2018, the United States (US) and China were engaged in adversarial tit-for-tat tariff increases and the US Federal Reserve (Fed) started to increase interest rates, but equity markets held steady for most of the year. Developed markets experienced record low levels of unemployment, global economic growth was strong, and inflation was well under control. By September 2018, the S&P 500 Index reached a then all-time high of 2 930 (+9.6% for the year to date). Yet, by year-end, the S&P 500 was down 14.4% from the record level in September and down 6.2% for the year. The markets feared that the negative impact of President Trump’s trade war with China had been underestimated, there were signs of a slowing global economy and concern that the Fed was raising interest rates too quickly at a time when the economic outlook was uncertain.

In South Africa, the share price of Steinhoff Holdings collapsed in December 2017. The country had to contend with the fallout of state capture after President Ramaphosa replaced predecessor Jacob Zuma in February 2018. Despite the feeling of optimism that prevailed (“Ramaphoria”), the FTSE/JSE All Share Index traded down for 2017 and the rand weakened by almost 14% over the year. Notably, the rand weakened by 25% from the strongest level (R11.55 on 23 February) to the weakest level (R15.42 on 5 September).

A telling aspect in South African financial markets was that listed property commenced a multi-year downward slide after reaching a record high in December 2017.

Looking to 2022

It is not appropriate to merely extrapolate the attractive returns from 2021 (extend the recent trend) into 2022 to formulate investment return expectations for the year.

Although economic and market conditions are very different at the start of 2022, compared with the start of 2018, there are several similarities worth considering:

- Global developed market equities are trading at all-time highs and valuations are stretched.

- The global economic growth outlook for 2022 is strong, despite a very strong recovery in global economies in 2021 from the 2020 recession.

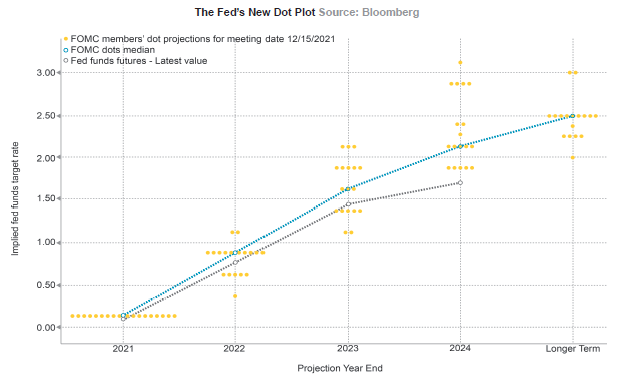

- Interest rates are expected to rise in 2022:

- In 2018, interest rates were increased in an attempt to “normalise” interest rates, rather than in response to inflation threats.

- Although interest rate “normalisation” is on the agenda, there is also an inflationary threat in 2022 that is driving a faster increase in interest rates.

Return expectations for the next year must recognise the complexity of financial markets and economic events that may drive markets up or down in this period. However, 2018 does remind us that the risk of a market correction in 2022 cannot be ignored when markets are “priced for perfection” and interest rates are increasing across the globe. If inflation doesn’t show signs of easing into the second quarter of the year, then interest rates may need to be increased at a faster rate.

Global equities

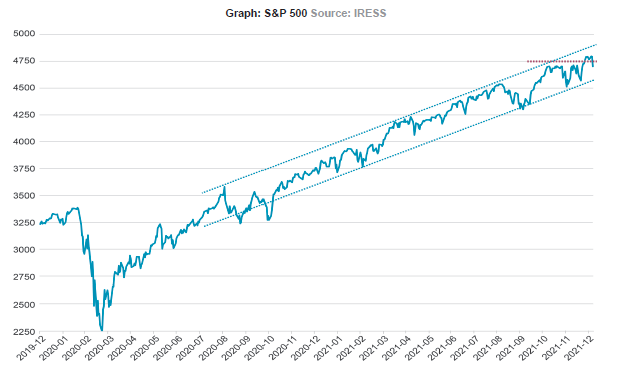

Starting with global share prices, it is appropriate to consider corporate valuations in developed markets such as the US, and interest rate hikes expected in 2022. Inflation worldwide is stubbornly high, with the US leading the pack, where inflation is at elevated levels. It is widely expected that the Fed will hike interest rates in 2022. It could be argued that some corporate valuations have reached demanding levels, particularly some tech shares that have reached “bubble territory” already. The downside risk of these shares is high. It is difficult to foresee global share prices (e.g. as measured by the S&P 500 in the US) gaining another 20% in 2022 after already adding more than 20% in 2021 and 40% from pre-Covid highs. Having acknowledged the risk attached to the US equity market, it is equally important to recognise that the strong earnings growth momentum experienced by many US corporates may continue into 2022. It would be folly to expect looming doom from global share prices. If stronger than expected Q4 2021 earnings are reported for US companies, the positive trend in stock market prices is likely to continue, at least for the early part of 2022.

A shift to emerging markets?

The economic recovery became evident in developed economies first (e.g. the US) and financial markets recovered accordingly. The US dollar strengthened significantly during the recovery, leading to relative weakness in other currencies, particularly when measured against the US dollar. As the economic growth impetus shifts from developed economies to emerging economies, it is possible that the strength of the US dollar may dissipate.

A shift to emerging markets may be further driven by much more favourable valuations of emerging market shares.

South African equities

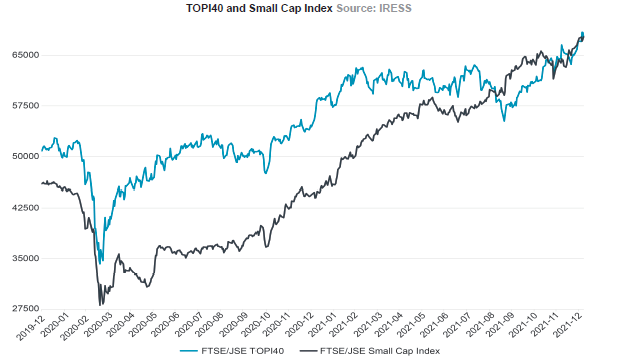

Domestic share prices have not reached levels as demanding as those in some developed markets. South African corporates are generally in good shape and operating off strong balance sheets. A clear indication of the underlying momentum of improving corporate South Africa is the FTSE/JSE Small Cap Index, which increased by more than 50% in 2021, the first year to yield positive returns since 2016. Improvement in the Small Cap Index typically occurs over a 2- to 4-year cycle. Large cap shares (i.e. TOPI40) frequently follow global trends in share prices and attract the interest of asset managers following a top-down asset allocation approach, and of foreign investors, but small cap shares more often reflect the consistent underlying strength or weakness of share prices in the domestic market

The dividend yield on small cap shares is not particularly attractive, but it should be kept in mind that many small cap stocks do not pay high dividends to shareholders, as positive cash flow from operations is reinvested in the business to finance future growth. Conversely, the dividend yield on the TOPI40 (3.73%) is attractive at present and reflects the strong cash flows generated by TOPI40 shares.

Furthermore, share prices on the JSE appear to be attractive to foreign corporates wishing to expand their footprint into the African sub-continent.

A general shift to emerging markets during 2022 is likely to favour South African shares.

Bonds and cash

Global bond yields are expected to rise in 2022 as policy interest rates are hiked and the accommodative approach by central banks is reduced. The return expectations for global bonds are therefore modest, and appear to be unattractive in 2022.

South African bond yields are attractive relative to peers. The yield to maturity of the R2032 that matures in March 2032 currently trades at 9.80% p.a. generating an investment return of more than 4.5% above inflation annually. Compared to the long-term performance expectation of domestic bonds (3.5% above inflation), the bond market is expected to offer attractive returns in 2022. Attractive as expectations of bond returns for 2022 may be, this asset class should still be evaluated relative to the expected opportunities in other market segments (e.g. shares).

The yield in the domestic money market, even if the policy repurchase rate is increased again in 2022, remains at historically low levels and the money market does not provide attractive opportunities at present.

Local listed property

Listed property reached an overheated peak in December 2017 and produced poor returns from 2018 to 2020. The FTSE/JSE Listed Property Index fell by 40% from the 2017 peak to pre-Covid levels (February 2020) and by a further 50% during the Covid crash (down 71.6% from the peak). Since the bottom of the Covid crash, it has recovered by 78%, which means it is still 15% lower than pre-Covid levels and 50% lower than its all-time high.

Then what is the prospect for property? It seems that protocols have been established to deal with Covid, even though it may be with us for a number of years. It has to be acknowledged that sub-A grade office and some retail rentals remain under pressure. However, industrial property (particularly logistic distribution centres) and the lower-end residential rental markets appear to be resilient. As a result, it is possible that listed property may continue its recovery to pre-Covid levels, but quite a bit of uncertainty remains in this sector.

The rand

The rand weakened by 7.8% in 2021. However, from January to June 2021, it strengthened by 9.4%, and from June to November 2021 it weakened by 17.6% despite the surplus on South Africa’s current account. The strong level of the rand (R13.42) coincided with the peak experienced in prices of major commodities exported by South Africa (platinum group metals and iron ore). It would be surprising if the surplus achieved on the current account in 2021 continues into 2022. However, with lively return expectations of domestic assets, it is likely that the rand could surprise by remaining stronger than anticipated by many.

Risks for 2022

Inflation presents the most evident economic risk. Energy prices are up, food prices are up, and distribution networks are under strain and struggling to cope with volumes post 2020. All these factors drive inflation upwards. Inflation may be transitory or temporary, but the risk is that high inflation may lead to more interest rate hikes than anticipated (a further economic risk factor). Financial markets currently anticipate that the Fed will hike interest rates three times in 2022 and three times again in 2023.

There are several geopolitical risks with which to contend in 2022: Commentators are referring to Cold War 2.0 when describing the ongoing tensions between the US and China, China will have its 20th Party Congress in October 2022 (leadership race), Russia’s sensitivity about the Ukraine is concerning, Iran’s nuclear ambitions are progressing, and Turkish President Erdogan’s populist economic approach is dragging Turkey down before the 2023 election. To the geopolitical risks one should add the very real risk of climate change, a turn for the worse of the Covid pandemic, and the ever-increasing technopolar world (US vs China).

In addition to the geopolitical risks, the socio-political risk in South Africa remains higher than previously anticipated. The shock events of July 2021 (rioting and looting) remain recent in many memories and questions are asked about possibly unrelated events such as the fire in the Parliament building. Perhaps not a risk as much as a possible disappointment, is the prosecuting authority’s lacklustre performance to date, which, should it continue, could turn the Zondo Commission Reports into nothing more than grand theatre. The ANC’s national elective conference is scheduled for December 2022. Again, this is not an investment risk, but it could lead to uncertainty if possible contenders resort to populist economic statements in the run-up to the conference.

A possible risk for financial markets is that the growth of corporate earnings may slow as interest rates go up and/or price-earnings multiples normalise. The price-earnings multiple for the S&P 500 is currently 27 times, which is equal to the average since 2017 but higher than the average since 2012 (23 times). Should the price-earnings multiple fall to 23 times while earnings increase by 10%, the S&P 500 will remain at approximately 4 500 (currently 4 700). If the S&P 500 price-earnings multiple remains at 27 times while earnings increase by 10%, the index will increase to 5 200. The conclusion is that share prices in developed markets are sensitive to the ratings afforded to the shares (price-earnings multiples).

The performance of offshore investments may come under pressure in 2022 and the anticipated interest rate hikes and sensitivity of the rating of shares in developed markets may well result in market pullbacks in 2022, similar to the dips experienced in May and September 2021.

Conclusion

The base case outlook for domestic equity, listed property and bonds remains robust and we anticipate reasonable returns from domestic exposure in 2022. The outlook for offshore developed markets appears to be more muted, while emerging markets such as China, India and commodity-producing countries could provide stronger returns. Inflation pressure resulting in interest rates being increased by a faster rate than the market anticipates, is a risk that cannot be ignored, especially because many developed market shares are “priced for perfection”.

Information for this article obtained from several sources:

IRESS, Bloomberg, Stats SA and Simeka Consultants and Actuaries