Is portable alpha the comeback kid investors can count on today?

By Nompumelelo Khumalo, Principal Investment Consultant

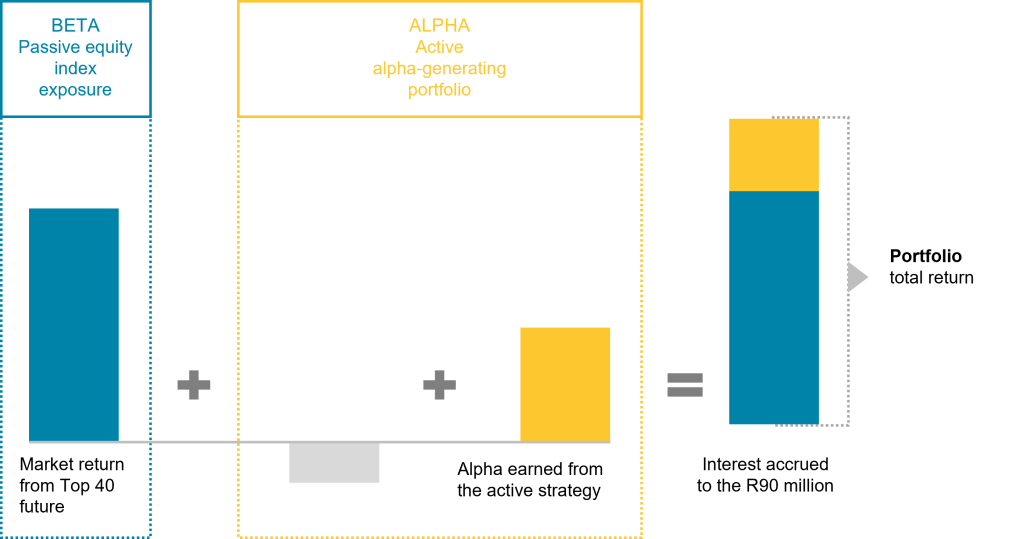

Portable alpha strategies date as far back as 1982, when Bill Gross and Myron Scholes combined S&P 500 futures with an active fixed income portfolio. The result would be portable alpha – a strategy that helps investors enhance performance by separating the two main types of returns in their portfolios:

- i) Beta, which is the return from simply following the overall market, like owning a broad stock index; and

- ii) Alpha, which is the extra return earned through skilled active management, like picking stocks or bonds that outperform the market.

The beta exposure is accessed using low-cost tools such as futures or swaps on broad stock indices. The alpha exposure is invested in active strategies aiming to generate alpha or returns above the market. This strategy enables investors to enjoy the steady returns of passive investing (beta), while adding the potential for extra gains from active investing (alpha), without needing to change their core portfolio structure.

Implementation

If an investor wants exposure to the JSE Top 40, instead of buying R100 million worth of each Top 40 stock directly, s/he might use futures contracts to get the same market exposure. But the investor only needs to put up a fraction of that money as margin. The remaining cash is invested in an active strategy that aims to outperform the cost of financing the futures, thus generating alpha. This is illustrated in the figure below:

| 1 | You have R100 million and want to have exposure to the JSE Top 40. Obtain exposure by buying a JSE future with a notional amount of R100 million. |

| 2 | You do not pay the full R100 million at the inception of the contract. Derivative exchange rules only require an initial margin (plus collateral and fees) of approximately R10 million leaving R90 million to invest elsewhere. |

| 3 | If you have the expertise, the R90 million can be invested in short-duration fixed income investments which you believe will yield positive returns. |

| 4 | When the futures expire, you will earn the market return (from the future) plus the return from the alpha strategy. You will also pay the R90 million plus any money market interest that would have accrued to the R90 million. This is paid to the counterparty in the futures agreement. The result is an enhanced market return (illustrated in the figure above). |

The rationale for using portable alpha

There is a debate around whether active management has a role to play in developed offshore markets. The supporting critique is that it is challenging to find managers who consistently outperform their benchmarks and can justify charging active management fees. That offshore managers struggle to outperform their indices is understandable. Developed market global equity indices consistently fall within the first quartile when ranked against benchmark-cognisant equity managers. This presents a challenge for investors seeking offshore exposures that deliver returns in excess of the index. In addition, any alpha earned by active managers can be eroded by fees. Similarly, after fees, the return earned on passive management is lower than the index return. A skilfully managed portable alpha strategy will deliver net-of-fee returns in excess of the selected benchmark. Investors can lock in the return that comes from market exposure, while accessing an alpha component whose outperformance is not eroded by fees.

Portable alpha in retirement funds

When portable alpha solutions are implemented in retirement funds, a combination of short- and long-term derivatives is utilised. The short-term derivatives provide liquidity for periodic retirement fund requirements such as member benefit payments. However, to access this liquidity, a three-month notice period can be required. To circumvent this three-month notice requirement, it is possible to allocate a proportion of the overall portable alpha strategy to a cash reserve, or to reduce the portable alpha exposure and invest a portion in listed, highly liquid assets. However, the effects of cash drag on performance must then be considered.

Not without challenges

While portable alpha can be a powerful tool, its risks must be managed diligently. Naturally, market crises and significant shifts in market conditions can destabilise a portable alpha strategy, as seen in 2008. With global risks intensifying over time, an investor implementing this strategy must remember that portable alpha does not eliminate market risk entirely. Secondly, for the strategy to be successful, the selected alpha source must yield a higher return than the cost of financing. In addition, the alpha source must provide sufficient liquidity to support an investor’s overall portfolio. Finally, execution complexity can be very challenging for investors with no experience in managing derivatives-based exposures. This solution is appropriate for institutional investors with robust governance structures and risk management frameworks. Overall, there is a possibility of compounding risk in unexpected ways. This highlights the importance of investors entrusting experts with this process. For retirement funds that are unwilling to bear the complexities of portable alpha, there are a number of well-established firms that have successfully afforded clients exposure to these solutions.

The bottom line

Portable alpha is not a “set and forget” strategy. It offers a smart way to combine steady market returns with the potential for extra gains from active management and, in certain markets, could provide more consistent returns than traditional active investing alone. However, it requires skill and experience to manage.

19 August 2025