Artificial intelligence in asset management: Enhancing judgement, not replacing it

By Marian Gordon, Regional Head and Principal Investment Consultant and Rushil Kalidas, Investment Consultant

Artificial intelligence (AI) is no longer a distant frontier. It’s a present-day force reshaping industries and driving transformation. According to CNBC, companies are investing significantly in AI-related data infrastructure and technologies, with megacap tech firms expected to spend as much as USD320 billion on AI technologies and datacentre expansions in 2025. But in the investment industry, where competitive edge and human judgment are paramount, the question remains: Is AI a game changer or does it merely represent another tech trend?

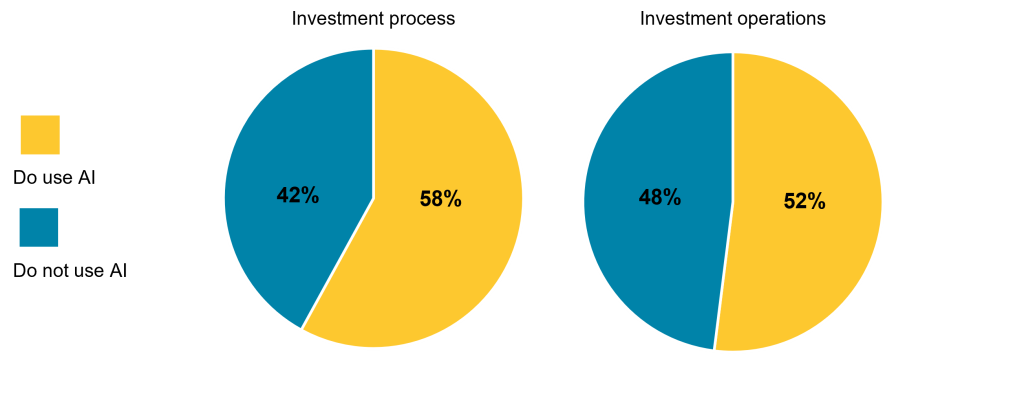

To explore this, Simeka surveyed a broad group of 31 investment service providers to assess how AI is being integrated into investment processes and operations. While the findings offer thematic insights, they are not intended to be exhaustive.

Current adoption

Of the 31 investment service providers surveyed, 11 reported no current use of AI. These were predominantly private market and boutique firms, suggesting that AI adoption may be influenced by scale, resources and strategic priorities. Of the remaining 20 managers which use AI, 58% use AI in their investment processes and 52% use AI in their operations.

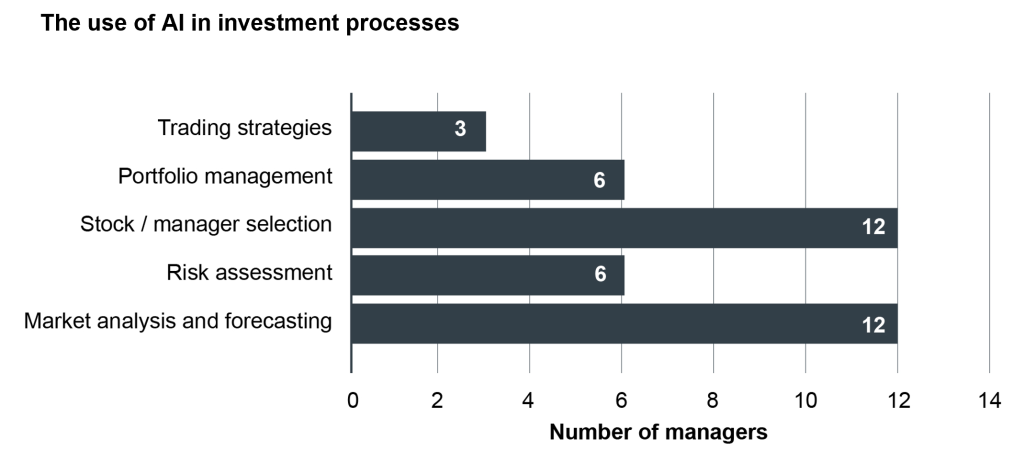

Among adopters, AI is beginning to play a more strategic role across the investment value chain. In market analysis, natural language processing is used to interpret the tone of central bank commentary, helping analysts distinguish between hawkish and dovish signals. For risk assessment, machine learning techniques such as K-means clustering are applied to categorise stocks based on behavioural and risk characteristics. In stock and manager selection, AI helps summarise vast volumes of data and converts written research into audio formats like podcasts, making insights more accessible and digestible.

Our survey highlighted that on the trading front, AI analyses macroeconomic indicators and formulates yield curve perspectives that can automatically trigger trades. These examples illustrate that AI is not just enhancing efficiency, it is actively shaping how investment professionals interpret data and execute strategies.

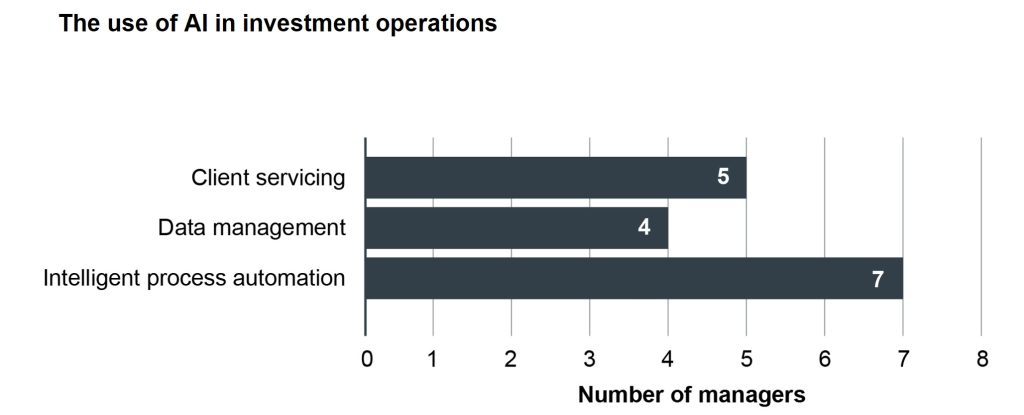

Beyond investment functions, AI is streamlining operations and enhancing productivity. Tools like Microsoft 365 Copilot are widely used to summarise meeting notes/documents and facilitate collaboration. Intelligent process automation is handling tasks such as invoice processing with minimal human intervention. Chatbots are assisting users with product and process-related queries, significantly reducing call volumes and improving service delivery. Workflow management has also evolved, with AI now capable of allocating tasks from email requests based on content and team expertise, ensuring faster turnaround and better resource alignment.

Enhancing human capability

AI is also supporting analysts in consuming research more efficiently, significantly speeding up the review and synthesis of complex information. Rather than replacing expert judgment, AI enhances human capabilities, allowing professionals to focus on higher-order decision-making while routine tasks are automated. This has led to measurable gains in productivity, reinforcing AI’s role as a strategic enabler rather than a disruptive force.

Future plans

As AI continues to advance rapidly, staying informed about its developments is crucial. While some organisations foresee limited impact on foundational investment philosophies, others expect AI to significantly enhance data analysis and the overall portfolio management process.

Despite this optimism, there is a broad consensus that AI is not a substitute for human expertise. Rather, it is viewed as a powerful tool that complements and amplifies human judgment. While some firms have integrated AI into their core operations, others are still experimenting.

However, the path to integration is not without its challenges. Concerns around data quality and security persist. These issues highlight the need for a measured and responsible approach to AI adoption.

Conclusion

The survey reveals a clear trend: AI is steadily gaining traction in the investment industry. Whether used for operational efficiency or analytical enhancement, its impact is becoming increasingly visible. For investment service providers, staying informed and adaptable is essential.

19 August 2025