Workplace burnout and financial stress – A holistic approach to employee health and retirement well-being

By Mbali Khumalo, Managing Director, Simeka Health

Workplace burnout and financial stress have emerged as critical challenges in organisations, affecting employees’ well-being, engagement, and long-term retirement security. This paper explores the interrelated nature of chronic conditions caused by these stresses and their long-term impacts and offers a holistic framework to enhance overall employee health and retirement well-being.

Burnout trends

Sanlam Corporate Wellness 2024/2025 data shows that burnout is primarily driven by personal stressors such as stress, anxiety, partner/spouse issues, and bereavement, as well as workplace challenges. High workloads, combined with presenteeism and work dissatisfaction, leave employees with little opportunity to rest and recover. This excessive workload makes them feel as if they have no control, leading to mental disengagement, growing negativity and cynicism, which ultimately intensify exhaustion and erode the joy of working. Burnt-out employees reported a range of negative outcomes, including diminished creativity and innovation, increased errors due to reduced attention, and heightened conflict and cynicism in interpersonal interactions. They also experienced lower productivity, suffered from poor physical and mental health, faced disruptions in personal and family life, encountered financial strain from inadequate support, and often neglected their own personal needs.

Financial stress as a compounding factor

Financial stress amplifies workplace dissatisfaction and overall well-being issues. It contributes to mental health decline, fuelling anxiety, depression, and sleep disorders – triggering physical ailments such as hypertension and heart disease. Moreover, it reduces productivity by diverting focus from work and heightening absenteeism, which exacerbates retirement insecurity by undermining financial planning and savings.

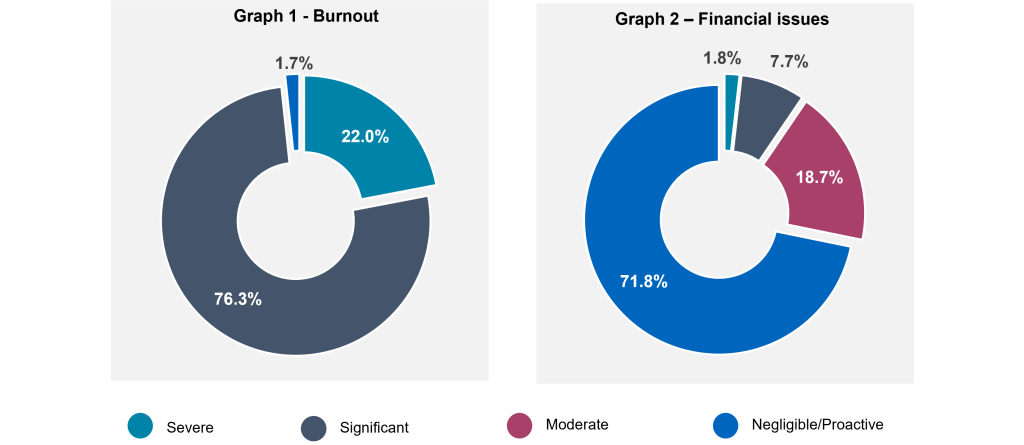

Sanlam Corporate wellness data analyses reveal a stark contrast between burnout and financial stress

According to Graph 1, 98% of burnout issues have a severe-to-significant impact on productivity, affecting individual well-being, as well as team performance and overall organisational success. In contrast, Graph 2 illustrates that 91% of financial issues are rated as having only a moderate-to-negligible impact on productivity. However, financial stress still led to significant personal challenges. These included low self-esteem, despair, insomnia, depression, anxiety, relationship difficulties, social withdrawal, various medical concerns, and unhealthy coping mechanisms, such as high alcohol consumption.

Thriving at work defined as growing, developing, and feeling energised, depends on removing obstacles that hinder meeting basic needs. Financial problems, particularly debt, adversely impact mental health by fostering anxiety, depression, and reduced resilience, especially when employees face constant pressure from collectors. Moreover, the burden of debt can make accessing mental healthcare more challenging, leading to untreated disorders. Although managing debt is difficult, seeking both emotional and financial support can improve one’s mental state and lower the risk of suicidal thoughts.

The intersection of burnout and financial stress

When workplace burnout combines with financial stress, the impact on employee well-being is severe. This dual strain makes employees feel trapped in unsustainable work environments, depleting their energy to combat burnout. Consequently, organisations face increased turnover, lower employee engagement, and accelerated deterioration in physical and mental health, all of which drive up costs and reduce overall productivity. Chronic workplace burnout and financial stress can lead to a range of both mental and physical health conditions. Some of the key chronic conditions and issues that have been linked to these stresses include mental health disorder, cardiovascular diseases, metabolic issues, musculoskeletal disorders and immune system dysfunction.

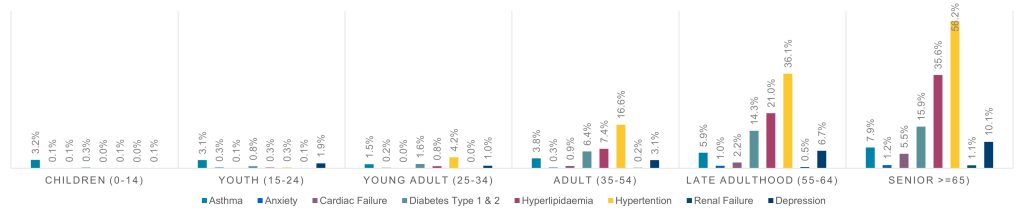

Medscheme’s Medical Scheme data analysis to investigate the potential impact of burnout and financial stress on the population, highlights that the age group 35-54 has the largest increase in chronic prevalence, and in the age group 65 and over, 3 out of 4 individuals have a chronic disease. Graph 3 indicates that although hypertension is most common in individuals over 65, many cases begin during the key working years (ages 25-34 and 35-54). This suggests that workplace burnout and financial stress may significantly contribute to the development of hypertension over the course of one’s career. For chronic individuals between the ages of 55 and 64, 50% of this population have had a chronic condition for longer than five years.

Graph 3 – Chronic profile (Registered – Prevalence)

What is more interesting is that during the work-life stage, 31% have had a chronic condition for longer than five years.

Post-Covid observations indicate that stroke admissions have risen notably in the 20-34 and 35-54 age groups, likely due to the compounded effects of the Covid-19 aftermath, workplace, and financial stress. Among main members aged 20-34, there was a substantial spike in stroke events post-Covid-19, with only a slight decrease in 2023 and 2024, suggesting sustained stress impacts even in populations without traditional chronic conditions. Meanwhile, the 35-54 age group has experienced consistent growth in stroke rates, with a 5,1% increase in 2024, emphasising that stroke events can act as catalysts for developing chronic conditions.

A holistic approach: Strategies for enhancing employee health and retirement well-being

A holistic approach to bolstering employee health and retirement well-being requires tackling both the symptoms and root causes of stress and burnout. This strategy involves financial wellness initiatives, mental health and stress management, organisational culture and systemic change and integration of health and financial benefits. Together, these measures create a supportive environment that addresses both immediate needs and long-term well-being.

Implications for retirement well-being

Workplace burnout and financial stress keep the body in constant “fight or flight” mode, exposing it to prolonged levels of stress hormones that damage various bodily systems over time. This not only reduces quality of life but also undermines long-term retirement well-being. Addressing these issues is essential for both immediate health improvements and for preventing chronic conditions in the future.

Organisations that invest in comprehensive wellness strategies demonstrate a commitment to the long-term prosperity of their workforce, which is crucial for attracting and retaining top talent. A holistic approach integrating mental health support, physical well-being strategies, and financial literacy can mitigate these risks. Such a strategy not only boosts current employee health, but also encourages proactive retirement planning, helping employees save and maintain the health needed for a productive post-retirement life. In doing so, both employees and organisations stand to benefit from a more engaged, resilient, and financially secure workforce. By addressing these issues in unison, organisations can create a supportive work environment that not only mitigates present challenges but also fosters long-term well-being and retirement readiness.

19 August 2025

Contributed by Simeka Health / This article was first published in Sanlam Benchmarks Insights 2025