Economic overview Globally and in South Africa

GLOBALLY

Global economic growth is slowing. This is evident from reports on a wide range of variables from around the world. According to the World Bank, economic growth is slowing because of:

- weak final demand

- soft global trade

- muted inflation

- mixed policy cues, and

- shifts in risk

As economic growth slows globally, both India and China still experience higher growth than other large economies such as the US, Europe and Japan.

Inflation around the world remains low. Amongst the G20 countries, inflation exceeds 3% a year in only six countries (Argentina 53.6%, Turkey 9.26%, South Africa 4.3%, Russia 4.0%, Indonesia 3.39% and India 3.21%). Low inflation confirms the low economic growth trajectory in the world.

To counteract slowing global growth, one expects monetary authorities to reduce policy interest rates to cushion the slowing economic growth and to stimulate growth going forward. But interest rates are low already.

This leaves monetary authorities with little room to adjust interest rates. It is easy to speculate that at some point in the future, monetary authorities might resort to asset buy-back schemes to increase liquidity and stimulate economic growth.

Nowhere is the global economic slowdown more evident than in the number of passenger vehicles sold. Passenger vehicle sales around the world is projected at 77 million units for the full 2019. This is down from the 78.6 million units that were sold in 2018, the 79 million units in 2017 and the 77.3 million units in 2016 (www.statista.com).

- In the US, the fed funds policy rate is 82% and the 10-year government bond yield is 1.53%.

- In Europe, the ECB accommodation rate is nil and the 10-year government bond yield is -0.6% (Germany).

- In Japan, the policy rate is -0.1% and the 10-year government bond yield is -0.2%.

(By comparison, South Africa’s repurchase rate is 6.5% and the 10-year government bond yield is 8.81%.)

An important aspect to consider is whether low interest rates around the world are the new normal, or whether we are seeing the formation and development of a bubble in bond yields.

A bubble in bond prices is premised on the principle that this time it is different. We live in a world where demographics, the demand for debt and the possibility of deflation have changed the landscape as central banks will continue to buy and hold any bonds to introduce liquidity into economies.

With debt in Europe and Japan at negative yields (investors pay governments to hold bonds), approximately 90% of positive-yield investment grade bonds are denominated in US dollars. This introduces two possible outcomes:

- A slowdown in global economic growth and the development of a bubble in bond prices, in which case one could invest in:

- government bonds in developed markets

- infrastructure bonds

- US$ cash

- listed property, and

- equities in undervalued currencies, avoiding value shares and

- A new normal where we muddle along, in which case one could invest in:

- emerging market bonds

- emerging market equities

- precious metals, and

- shares in the energy, financial and consumer cyclicals sectors – avoiding government bonds in developed

The state of international trade presently contributes to uncertainty. Trade negotiations seem to be aimed at protecting regional interests and nodal economies (e.g. in the US) rather than growing the global economy as a whole. This is evident from the tough approach followed by the US and from the possible impact of the UK’s deal/no- deal approach to BREXIT.

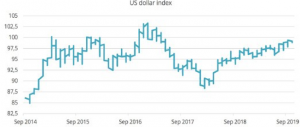

Key to understanding events that may unfold going forward, is the continued strength of the US dollar. The US dollar index (against a basket of currencies) has been strengthening since Q1 2018. This could be the result of the improvement of the US’s relative economic position in the world, but the role of the US dollar as the de facto reserve currency of the world could also contribute to US dollar strength. It is speculated that non-US banks, especially in Europe, create significant demand for additional dollars by their practice of extending international loans in US dollars. By extension then, the greater the uncertainty in the world, the greater the demand for US dollars.

In a world where there is underlying strength in the US dollar, other currencies (such as the South African rand) adjust accordingly.

-

IN SOUTH AFRICA

South Africa’s economy has been pipped in the race to the bottom only by Argentina. Our year-on-year economic growth up to June 2019, at 0.8%, is not sufficient to meet the expectations of those who live in the country. Furthermore, growth is unlikely to improve significantly in the next year.

Our immediate challenges include the looming final downgrade of our sovereign credit rating to non-investment grade and the short-term funding of Eskom. An unfavourable outcome on either or both these issues is likely to bring pressure to bear on financial markets.

After a solid start to 2019, investment returns remained both under pressure and volatile.

The yields on the major investment asset classes in which retirement funds could have invested were as follows:

| % change September 2019 | 3 months

% |

YTD

% |

1 year (p.a.) | 3 years (p.a.) | 5 years (p.a.) |

| FTSE/JSE All Share Index TR | -4.6% | 7.1% | 1.9% | 5.1% | 5.3% |

| Capped Shareholder Weighted Index TR | -5.1% | 1.4% | -2.4% | 1.1% | 3.4% |

| Listed Property TR | -4.4% | 1.3% | -2.7% | -3.5% | 3.2% |

| STeFI Composite Index TR | 1.8% | 5.5% | 7.4% | 7.4% | 7.2% |

| BEASSA All Bond TR Index | 0.7% | 8.4% | 11.4% | 8.9% | 8.3% |

| MSCI All Country World TR Index ZAR | 7.5% | 23.1% | 9.1% | 14.0% | 13.7% |

| Barclays Global Aggregate Bond Index ZAR | 8.1% | 12.1% | 15.1% | 5.0% | 8.2% |

| Rand/USD (+ appreciates, – depreciates) | -6.8% | -5.2% | -6.5% | -3.1% | -5.1% |

| Inflation (August 2019) | 1.0% | 3.4% | 4.3% | 4.9% | 6.5% |

As economic growth around the world slows, the investment opportunities we currently see in South Africa are:

- a positive contribution from global share exposure, particularly from a shift to emerging markets (e.g. India, China, Indonesia, Taiwan )

- some recovery in domestic share prices based on a 9% consensus earnings forecast for the next 12 months

- a continued near 5% after-inflation

return from South African bonds.

In spite of the many aspects from around the world which may cause concern, our investment savings are robust after having absorbed a great deal of pressure. We are reaching the point from where recovery normally occurs after a downtrend.

ON A DIFFERENT NOTE

A topic that has dominated discourse in the retirement fund environment recently is prescribed investments for retirement funds. This follows the statement of intent made by the ANC in its election manifesto to request the investigation of the desirability of prescribed assets.

The reaction was sharp and generated fierce debate. Some financial advisors have even recommended that members of retirement funds cash in their retirement savings to invest this money offshore.

For prescribed assets to be introduced, section 19 of the Pension Funds Act, 1956 (Act 24 of 1956) and the accompanying Regulation 28 in Annexure B of the Act will have to be amended. Section 98 of the Financial Sector Regulation Act, 2017 (Act 9 of 2017) requires extensive engagement by policymakers and following a consultation process before any changes can be made to legislation to allow for prescribed assets. The consultation process should be followed by further debate via a parliamentary phase. Only after parliament approves legislation, it is referred to the President before it can become law. No such process has been initiated and hence we are not in any state of panic – at least for now.

Therefore, it is not true that a Minister of Finance (who would publish amendments to the financial regulations including Regulation 28) can simply change financial regulations to introduce prescribed assets.

We should expect investment regulations for retirement funds to be reviewed and debated regularly by policymakers, considering a number of factors including the favourable tax environment that applies to retirement funds. It is important to understand the context of recent statements about prescribed investments and that the statement of intent in an election manifesto to investigate a matter that is being discussed regularly, should not cause unnecessary alarm.

WHAT IS THE NOISE ABOUT PRESCRIBED ASSETS ALL ABOUT?

Prescribed assets were first introduced to South Africa as far back as 1958, when retirement funds were required to invest a minimum of 40% of the market value of assets in bank deposits and/or government issued bonds. Arguably, prescribed assets were introduced to ensure adequate diversification of retirement fund assets and to provide Government with the opportunity to mobilise retirement fund savings. At the time, most employers who provided employees with pension plans invested in insured pensions.

South Africa’s GDP growth rate accelerated to more than 5% a year during the 1960s and remained at elevated levels through the 1970s. The dividend yield on shares also exceeded 5% a year throughout the 1960s and 1970s. By the end of the 1970s, most employers provided employees with access to defined benefit pension plans. A member’s pension was typically determined by the multiplication of years of service, average final salary and a pension factor (e.g. 2%). For example, after 40 years’ service, an employee whose average final salary was R10 000 a month (R10 000 a month x 12 = R120 000 a year) would have earned a pension of R8 000 a month or R96 000 a year (R10 000 x 12 x 40yrs x 2%).

In this environment, employers guaranteed the pensions paid to pensioners, but pension fund surpluses also belonged to the employer.

During this favourable period and into the 1980s, the requirement to invest in prescribed investments was lifted to 53% of the market value of assets and government guaranteed bonds, e.g. Eskom and Transnet bonds were included in the basket of prescribed assets.

The impact of prescribed investments was to reduce the after-inflation investment returns for retirement funds. Prescribed investments created additional demand for government bonds, which resulted in a lower yield earned on these bonds. It is important to understand that during this period of prescribed investments, individuals were protected from the possible impact of lower yields, as employers assumed the investment risk of the pension plans.

In May 1989, prescribed investments were abolished. As share prices boomed, the dividend yield came down to 3% and after-inflation interest rates improved. Many retirement funds had surpluses and converted to defined contribution status to provide members with their share of growing surpluses and transferring investment risk to members.

The (financial) environment in South Africa has changed since the 1960s. The present discussion about prescribed assets is aimed solely at the mobilisation of retirement savings in the national interest. Yet, as in the 1960s, the framing of what the national interest actually entails is controversial. As in the 1960s, the introduction of prescribed investments is expected to lead to lower yields because of the additional demand for prescribed assets created artificially.

By 2019, members in retirement funds have suffered low investment returns for five years already, creating pressure on members in defined contribution pension plans. The ability of members to absorb even lower investment returns as a result of considerations such as prescribed assets is much more limited/reduced compared to when prescribed investments were required previously.

Simply put, as ordinary members, we do not have the budget for even lower investment returns.