Lessons from Lockdown – A Consultant’s Perspective

By Riaan Botha, Head: Benefit Consulting and Actuary

We already had quite a bit going on in our industry with the economic downturn, default regulations, muted investment returns … and then this happened. There is a lot of commonality in COVID-19 and lockdown experiences across geographies, industries and individuals. We zoom in through the lens of the employee benefits consultant and reflect on some valuable lessons learnt and realisations that have dawned on us over the past few hectic months.

Cutting through the noise

Information overload, meeting upon meeting, and many opinions became the order of the day – merely keeping up with what’s been happening out there has been an exhausting effort. It requires a depth of legal and technical resources and industry experience filtering through this at the required pace, so that consultants are enabled to guide clients through the complexity and turmoil. The lockdown has been a true test for the operational efficiency, calibre of resources, and strength of client relationships of consultancies.

Digital Catalyst

Digital solutions are nothing new. Significant investments have been made across product and solution ranges over a number of years – impressive for business pitches, but low in real take-up.

It’s been a continuous effort changing the behaviour of the technological laggers. A forced change in modus operandi has cemented new behaviours that are here to stay – for consultants, providers, funds and members.

Electronic agenda solutions not only save paper, but also centralise document management, are cost effective, and better address cyber security.

In most instances, trustee and committee meetings are managed successfully via online platforms, although logistical and connectivity challenges will remain for some. Reducing the travel load will bring obvious efficiencies for consultants and clients.

Quarterly meetings are insufficient in dealing with the rate of change. Digital solutions will enable more regular and focused meetings, which have become unavoidable for decision makers.

It’s about balance

There is no replacement for building and strengthening client relationships through real face-to-face engagement. Post lockdown, it will be about balancing the new way of online connection with the personal touch. It will be challenging convincing prospective clients to appoint you as consultant via a disrupted two-dimensional visual engagement.

Similarly, the consultant workforce will drift apart to some extent if working from home is not balanced with office attendance and team sessions. This is especially relevant for younger people who would learn better in an office environment. Not everyone has a work-friendly home environment.

The agile all-rounder

Good consultants thrive in challenging and complex times. This is when most value can be added to clients by solving their unique problems in a properly researched and pragmatic way. The lockdown has tested technical and product knowledge, management consulting ability, fast learning, adaptability, benefit architectural insight, implementation and project management skills – jack of all trades and master of some. Having access and being able to involve highly specialised resources are equally important.

The lockdown has also tested how consultancies went about their business. It has demonstrated the difference between a strategic business partner and a service provider, and between a complete consultant and a broker.

Taking a bit of a blow

Compared to other industries and professions, employee benefits consultants have not been the hardest hit by the immediate impact of COVID-19 and the lockdown. In fact, the workload has increased as a result of various regulatory changes and many clients being in distress. In terms of the business model, income is often linked to the headcount, asset base or payroll of institutional clients. The economic pressure is likely to reflect more prominently in employment numbers from the third quarter onwards. This is expected to result in a strain on consulting income while having to maintain an increased workload, even after allowing for the efficiencies of the new way of work.

Who is the client?

Although the traditional role of technical advisor to institutions remains critical, the focus on the individual member is paramount. While Default Regulations already demand individual member focus, the lockdown demonstrates the importance of targeted communication, education, counselling and individual advice in times when members are panicking and are faced with tough financial decisions.

What is consulting?

Consultants are mainly regulated on advisory and intermediary functions in respect of employee benefits-related products. The fixation on independence also stems from the consultant’s relationship with product houses and the management of conflicts of interest.

Although broking functions are key, there is a lot more to do. Technical and strategic advice goes beyond products. Consultants are solution architects and implementers, fulfil secretarial duties, and are instrumental in individual member strategies. They are also pivotal in stakeholder management and the smooth operational functioning of the client’s employee benefits ecosystem.

The future for consultancies is offering a holistic value proposition across healthcare, wellness and retirement benefits at institutional and member level.

What clients want

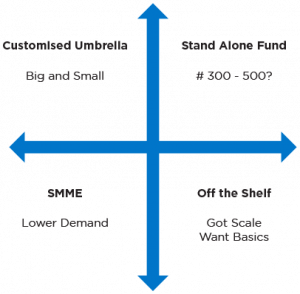

Initially it was SMMEs converting to umbrella solutions on economies-of-scale principles. Umbrellas started as pure products and transformed into flexible platforms. Larger clients with a lower appetite for customisation, control and governance then converted too. More recently, default regulations have placed an additional onerous burden on trustees and the regulator is tightening the screws – a lot more is required parallel to primary business. The lockdown has intensified it all, which will trigger a third wave of conversion and consolidation. The expectation is that 300 to 500 stand-alone retirement funds will remain.

The different client segments as illustrated above require consultancies to have cleverly designed and transparent value propositions for each. It starts with listening and understanding what clients want as opposed to pushing a predetermined offering. The key is to get the mandate clear early on and align it with the client’s interests. Clients may want anything ranging from a specialised component of advice to a holistic implemented employee benefits solution.

Setting up properly

The Retail Distribution Review formalises the rules of engagement for consultancies and is expected to be effective soon.

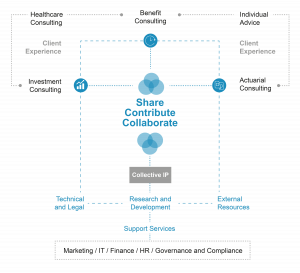

The key asset of a consultancy is its intellectual property which, in its raw form, consists of the skills and knowledge of its people, learnings from ongoing client experiences and research.

Consultancies require operational platforms that enable collaboration, sharing and contributions from all components, which then convert intellectual property from its raw form to customised solutions.

Silos need to be broken down and access is required to essential supporting resources. Getting this right will set consultants up as thought leaders.

Heavy agenda

Consultants have their work cut out. Top of the list are investment themes such as default strategies; market volatility; infrastructure funding; environmental, social and governance factors; and prescribed asset dialogue.

Annuity product research remains key as retailisation in the institutional space drives innovation, resulting in narrowing pricing gaps.

The lockdown experience will influence future risk policy conditions and pricing, especially affordability of traditional permanent health insurance benefits.

Individual member engagement, counselling and advice solutions remain fluid, with early experience and learnings unfolding post the commencement of default regulations and fintech drives. Certain clients go beyond the minimum requirements, giving rise to a fee-for-service model covering all employee categories. Retrenchments will require specific focus.

The Financial Sector Charter will demand real transformation strategies for retirement funds and service providers. In the stand-alone fund space there will be increasing demand for demonstrating governance assurance.

Consultants with actuarial capabilities will empower decision makers with valuable analytics and management information. Actuaries will assist clients in addressing benefit projections and sustainability testing requirements. With extreme short-term market volatility, temporary relief strategies and operational challenges, mismatching and processing risks have increased. Even valuation-exempt funds may require an actuarial investigation for 2020.

The ongoing debate regarding the concept of a retirement date, various savings goals such as housing or emergency funds, and accessibility of funds will shape the future.

Consultants are more than advisers. They are employee benefits solution architects and implementers. Looking ahead, consultants have to be hands on with immediate issues, do the basics exceptionally well, and bring some x-factor to the game. In essence, the future is the sum of all present moments.