Update on the investment outlook for 2023 – 17 July 2023

Update on the investment outlook for 2023

Retirement fund members invested in growth portfolios should have banked a return of approximately 8% halfway through 2023. (Actual performance will vary materially based on the actual portfolio in which retirement fund members are invested.)

The index-based composite return for the half year to June 2023 is 11.5% for a growth portfolio that maintains high exposure to domestic shares and 13.6% for an index-based composite with higher exposure to offshore shares. The index-based composite portfolio has generated better investment than those achieved by most balanced fund managers (aggressive asset allocation, no trading cost, no management fees).

| Asset allocation | Investment return to June 2023 | Asset allocation | Investment return to June 2023 | ||

| Domestic | Shares | 42.5% | 5.9% | 32.5% | 5.9% |

| Property | 5.0% | -4.4% | 5.0% | -4.4% | |

| Bonds | 15.0% | 1.8% | 15.0% | 1.8% | |

| Money mkt | 2.5% | 3.7% | 2.5% | 3.7% | |

| Offshore | Shares | 32.5% | 26.5% | 42.5% | 26.5% |

| Bonds | 2.5% | 12.3% | 2.5% | 12.3% | |

| Total | 100.0% | 11.5% | 100.0% | 13.6% |

Where is our outlook on the mark and where do we miss the mark?

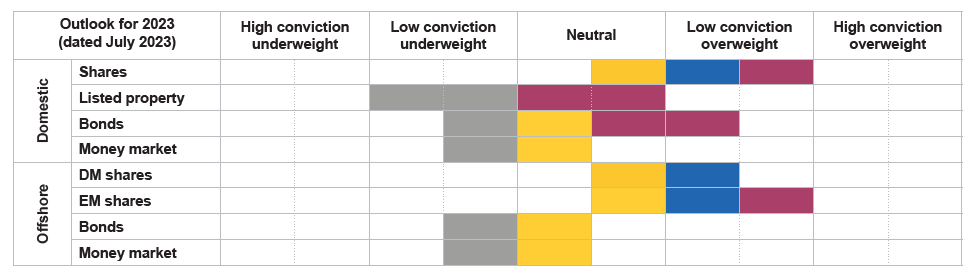

Refer to Simeka’s Investment Notes 2/2023) for our asset class outlook for 2023 as at April 2023.

Our expectation of low double-digit returns for domestic share prices remains on track. The FTSE/JSE All Share Index TR added 5.9% for the six months to June 2023. Based on expectations of reduced cost of capital, lower inflation and improved conditions going forward, we maintain our initial projection. Our faith in offshore shares was rewarded, but developed markets outperformed emerging markets. Finally, the weakening trend of the US dollar was expected to prevail and with a weaker dollar, our initial expectation was that the rand/US dollar exchange rate would strengthen moderately. However, the rand has weakened materially for the year to date. The weaker rand has supported rand-based returns earned from offshore shares and bonds.

Our outlook in April 2023 was premised on a positive outlook for both domestic and offshore bonds, based on the expectation of lower inflation and a turning interest rate cycle. Inflation did come down in the first half of 2023, but at a much slower rate than anticipated. Consequently, interest rates were hiked by more than anticipated. Instead of driving investment returns, domestic bond exposure detracted from performance in the six months to June 2023. Thus far, our projection for domestic bonds has not been on the mark, but we maintain our premise that bonds (domestic and offshore) are likely to generate strong investment returns when the interest rate cycle turns. It is now evident that the anticipated rate cuts have been pushed out by some months. We moderated our projection for listed property in April 2023. Inflation-linked bond (ILB) yields and listed property prices are inversely correlated. When ILB yields go up, listed property prices experience headwinds and when ILB yields come down, listed property prices strengthen. Anticipating an imminent turning interest cycle, we expected listed property to perform better. As in the case of bonds, the improved performance of listed property has been pushed out by a few months.

We also did not foresee the double blow to the rand/US dollar exchange rate, initially weakening from R17.00 to R18.30 in February 2023, driven by non-residents selling exposure to SA shares and bonds. In May 2023, it softened from R18.30 to R19.80 because of South Africa’s geopolitical position. In the course of June 2023, the rand recovered to R18.30 but weakened again to R18.86 at quarter-end.

The question now is: What will happen in the second half of 2023?

With the investment returns for the first six months of 2023 in the bank already, one should be able to assess the projections for the remaining half of 2023.

Looking forward, we believe three overarching themes could drive financial markets.

Firstly, as the interest rate cycle turns, domestic and offshore shares, bonds and properties should see better investment returns. The challenge is to get the timing of the interest rate cycle right. In addition to local inflation, the Reserve Bank’s Monetary Policy Committee must also consider the yield differential between South Africa and developed markets such as the US, to ensure that the yield on South African interest-bearing investments remains sufficiently attractive for non-resident investors.

Secondly, while the business and consumer confidence indices do not currently reflect the green shoots in the economy, we believe that the less severe load shedding experienced so far this winter should have a positive effect on the South African economy. There is a reasonable prospect that load shedding may not be as severe in the next six months as in the first half of 2023, but the prognosis remains risky. We believe economic conditions may improve more rapidly than anticipated previously, amid expectations of inflation coming down in the second half of 2023, lower interest rates for 2024, an improvement in the current account deficit and more resilient economic output.

Thirdly, as the US interest rate cycle turns, we expect global investors to adopt risk-on strategies, which would benefit emerging markets. Amongst emerging markets, South Africa remains less attractive than many of its peers, but our financial markets should still benefit from a risk-on ambience.

Should the themes above materialise, it is highly likely that the rand exchange rate may experience a period of relative strength.

We acknowledge that there are factors that may slow the global and domestic economic recoveries on which our optimistic outlook relies. Amongst these are the fragility of South Africa’s fiscal position and the fact that National Treasury is effectively starving the private sector from access to capital by issuing bonds at high yields, the economic dynamics in the Far East (China and Japan), and service/salary inflation in Western economies.

Nevertheless, the projected average inflation rate for 2023 and the year-end yield to maturity of the 7-year government inflation-linked bond remain key to our outlook for the remainder of 2023. We project average inflation for 2023 at 5.8% (up from the projected 5.6% in January 2023), and the yield to maturity of the 7-year bond is up 0.34% (we projected a downward move of 0.25% in January 2023).

Two scenarios

For the remainder of 2023, two possible scenarios are described below.

In the careful scenario, where inflation remains relatively sticky and the 7-year government inflation-linked bond yield remains at around 4.43% p.a., we expect single-digit returns for domestic shares, negative returns for listed property and pedestrian returns for domestic bonds. If these conditions prevail, the rand might remain weak with offshore shares and bonds continuing to add value to retirement fund returns. In this scenario we expect retirement funds to earn low double-digit returns for calendar 2023.

In the positive scenario, if inflation comes down and the market starts to anticipate the interest rate cycle turning (e.g. with the 7-year government inflation-linked bond closing the year at lower than current yields), we expect an enhanced return from domestic shares, an improvement in listed property performance and inflation-beating returns from domestic bonds. The rand may be able to maintain relative strength, but offshore shares and bonds would still contribute positively to retirement fund returns. In this scenario we anticipate a possible global risk-on trade, with retirement funds earning approximately 3% more than the investment returns in the careful scenario in 2023.

Differences in the outcome of the positive scenario are shown in pink in the table below.

We believe that retirement fund members should aim to achieve an investment return of 5.5% above long-term inflation and after fees over their savings lifetime. Currently, this is equal to a nominal return of 12.5% p.a. Achieving the required rate of return could be achieved in 2023 appears to be possible.

Information for this article has been obtained from IRESS